Tesla, Inc. has swiftly risen to prominence as a trailblazer in the realms of electric vehicles (EVs) and sustainable energy solutions, revolutionizing the automotive sector with its cutting-edge innovations and bold ambitions for a greener future. The company’s visionary strides in electric transportation and energy systems, combined with its expanding global influence, have made it a frequent topic of conversation among investors around the world.

As of May 2024, Tesla’s stock (TSLA) remains under constant scrutiny within the financial sphere, particularly given its volatile yet promising performance and substantial growth prospects. To truly comprehend the intricacies of Tesla’s stock, one must delve into the various factors influencing its valuation and market trajectory. A vital tool for investors seeking clarity on Tesla’s stock is FintechZoom—a premier financial analysis platform offering real-time data, predictive analytics, and in-depth analytical tools.

In this piece, we examine how FintechZoom’s resources can aid investors in making informed decisions regarding Tesla stock. We will explore Tesla’s market position, performance metrics, and projections, as well as analyze how FintechZoom’s advanced features can assist those considering Tesla as part of their investment portfolio.

Tesla Stock and Its Investment Landscape: A Comprehensive Overview

Tesla’s stock has become synonymous with both significant volatility and rapid growth, largely driven by the company’s groundbreaking achievements in electric mobility, clean energy, and autonomous driving technology. The stock has captured the attention of not just traders and investors, but also those captivated by innovation and the evolving future of sustainable transportation.

Tesla’s Market Standing and Performance Insights

Tesla has cemented its role as a dominant force in the global electric vehicle market. Despite escalating competition from both established automakers and new challengers, Tesla’s relentless innovation, robust brand identity, and extensive infrastructure have maintained its competitive edge.

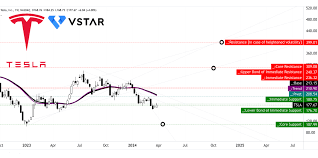

As of November 2024, Tesla’s stock (TSLA) is trading at approximately $311.18 per share, reflecting a modest decline of 5.78% from the previous close. However, this slight dip does little to obscure the company’s consistent upward trajectory over the long term. Tesla’s third-quarter 2024 results revealed a net income of $2.1 billion, with vehicle deliveries climbing 10% year-over-year to around 450,000 units. Tesla’s energy division also saw a 20% increase in energy storage deployments, underscoring the company’s expanding footprint in the clean energy market.

Notable achievements for Tesla include:

- Cybertruck Production: The much-anticipated Cybertruck has officially entered production, with deliveries expected by year’s end, generating significant buzz among both investors and consumers.

- Expansion in China: Tesla’s Shanghai Gigafactory recently achieved a major milestone, producing its 1 millionth vehicle, solidifying its presence in one of the largest automotive markets globally.

- Advancements in Autonomous Driving: Tesla continues to enhance its Full Self-Driving (FSD) beta program, reinforcing its position as a leader in autonomous vehicle technology.

Despite mounting competition and regulatory challenges, Tesla’s strategic initiatives position it for continued leadership within the electric vehicle and clean energy sectors.

The Role of FintechZoom in Tesla Stock Analysis

FintechZoom stands at the forefront of financial analysis platforms, offering real-time stock tracking, market trends, and AI-driven insights. For investors seeking to monitor Tesla’s stock performance and make well-informed decisions, FintechZoom’s array of features is invaluable. Let’s delve into the benefits of using this platform for Tesla stock analysis:

- Real-Time Data and Updates: FintechZoom provides continuous, real-time updates on stock prices, market shifts, and financial news, ensuring that investors always have the latest, most accurate information at their disposal. This feature is essential for Tesla investors looking to track fluctuations and understand the forces driving changes in stock value.

- AI-Powered Analysis and Projections: A standout feature of FintechZoom is its AI-driven analysis, utilizing advanced algorithms to evaluate Tesla’s stock performance. By scrutinizing historical data and detecting patterns, FintechZoom generates predictions about future stock movements, giving investors a forward-looking perspective that is invaluable for decision-making.

- Portfolio Optimization and Stock Screening Tools: FintechZoom’s Stock Screener and Portfolio Optimizer allow investors to filter stocks based on specific criteria such as market cap, P/E ratio, or dividend yield. This helps investors identify how Tesla fits into their broader investment strategies. The Portfolio Optimizer further suggests how to integrate Tesla into a diversified portfolio.

- Detailed Reports and Market Insights: FintechZoom produces comprehensive reports on Tesla’s financial health, competitive landscape, and market outlook. These reports are crucial for investors conducting due diligence before making decisions. By understanding Tesla’s earnings, market standing, and associated risks, investors can more accurately assess the potential rewards and challenges of holding Tesla stock.

Key Drivers of Tesla’s Stock Performance

Several critical factors influence the trajectory of Tesla’s stock price. These elements—ranging from technological innovations to shifts in market dynamics—have a direct bearing on Tesla’s performance and future growth potential.

- Technological Breakthroughs: Tesla’s unwavering focus on innovation is a primary driver of its stock price. Key areas such as electric vehicle batteries and autonomous driving technology significantly impact the company’s growth trajectory.

- Battery Advancements: Tesla’s innovations in battery technology, such as the 4680 battery cell, promise to revolutionize the electric vehicle landscape. With superior energy density and reduced production costs, these breakthroughs will make Tesla’s vehicles more affordable and extend their driving range, attracting a wider consumer base. Additionally, Tesla’s adoption of lithium iron phosphate (LFP) batteries, celebrated for their cost-efficiency and safety, further strengthens its position as a leader in battery technology. FintechZoom continuously monitors these advancements, predicting their influence on Tesla’s stock performance.

- Autonomous Driving Innovation: Tesla’s Full Self-Driving (FSD) system is another pivotal factor shaping its stock performance. As Tesla refines its FSD capabilities, the demand for autonomous vehicles is expected to surge, bolstering Tesla’s market appeal. The increasing sophistication of this system positions Tesla as a key player in the future of autonomous driving.

- Market Shifts and Sustainability Trends: The global push for sustainability is another critical factor influencing Tesla’s stock. Worldwide, governments are incentivizing the adoption of electric vehicles through tax credits, subsidies, and stringent emissions regulations, all of which benefit Tesla, a leader in the electric vehicle sector.

- Rising Demand for EVs: Consumer demand for sustainable transportation options continues to grow, and Tesla is poised to capture an ever-increasing share of the global electric vehicle market. FintechZoom forecasts that Tesla will command 25% of the global EV market by 2025, driving substantial revenue growth.

- Government Incentives and Emissions Regulations: Policy incentives such as tax rebates for EV purchases are helping accelerate the transition to electric vehicles, creating a favorable environment for Tesla’s growth. FintechZoom tracks regulatory developments and assesses how changes might impact Tesla’s sales, revenues, and stock price.

- Competition and Risks: Tesla faces formidable competition from both traditional automakers and new entrants. While established brands like Ford and Volkswagen and startups like Rivian and Lucid Motors challenge Tesla, the company’s technological innovations, brand loyalty, and expansive Supercharger network give it a substantial edge.

FintechZoom closely tracks the competitive landscape, assessing how Tesla’s technological dominance and continued innovation set it apart from other market players, positioning it for long-term growth.

FintechZoom’s Outlook for Tesla Stock

FintechZoom offers a favorable long-term outlook for Tesla, setting a 12-month price target of $340 per share. This projection signals confidence in Tesla’s ability to sustain its growth and innovation trajectory.

- Revenue and Earnings Projections: FintechZoom forecasts a 35% increase in Tesla’s revenue in 2024, alongside a 45% rise in earnings. This robust growth is expected to stem from increased vehicle production, new product deliveries, and continued expansion within the energy sector.

- Upcoming Product Launches: Major product launches, such as the Cybertruck and Tesla Semi, are anticipated to drive Tesla’s growth, opening up new markets and bolstering both consumer and commercial sales.

Conclusion

Tesla remains one of the most exciting and dynamic players in the stock market. With its relentless focus on innovation, sustainability, and market leadership, Tesla is poised to remain a significant force in the years to come. While competition and regulatory challenges exist, Tesla’s commitment to groundbreaking advancements continues to drive its growth potential.

Investors can leverage FintechZoom’s comprehensive analysis, real-time data, and predictive tools to make informed decisions about Tesla stock. As Tesla continues to expand its product line, ramp up production, and maintain its leadership in autonomous technology and energy solutions, its stock will likely remain a key focal point for investors worldwide.

Through the insights provided by platforms like FintechZoom, investors can navigate Tesla’s stock with confidence, staying ahead of market trends and optimizing their investment strategies for maximum returns.